Will Disney’s Move to Leave Netflix Prove to Be a Big Mistake?

With Netflix still the runaway leader, the video streaming business has never been more prosperous, counting today 11 VOD services (including HBO, Hulu, Amazon, YouTube,…) that reach 1 million or more homes in a given month. And Disney has decided it wants a share of the pie!

But could it be too late for the multi-billion-dollar company to enter the game?

Earlier last week – and confirming the entertainment giant’s announcement in August that it will be ditching Netflix for its own streaming service – Disney’s CEO Bob Iger declared that the company will launch the new, ad-free platform by 2019. “We’re going to launch big, and we’re going to launch hot,” he said during the Bank of America Merill Lynch 2017 Media, Communication & Entertainment Conference.

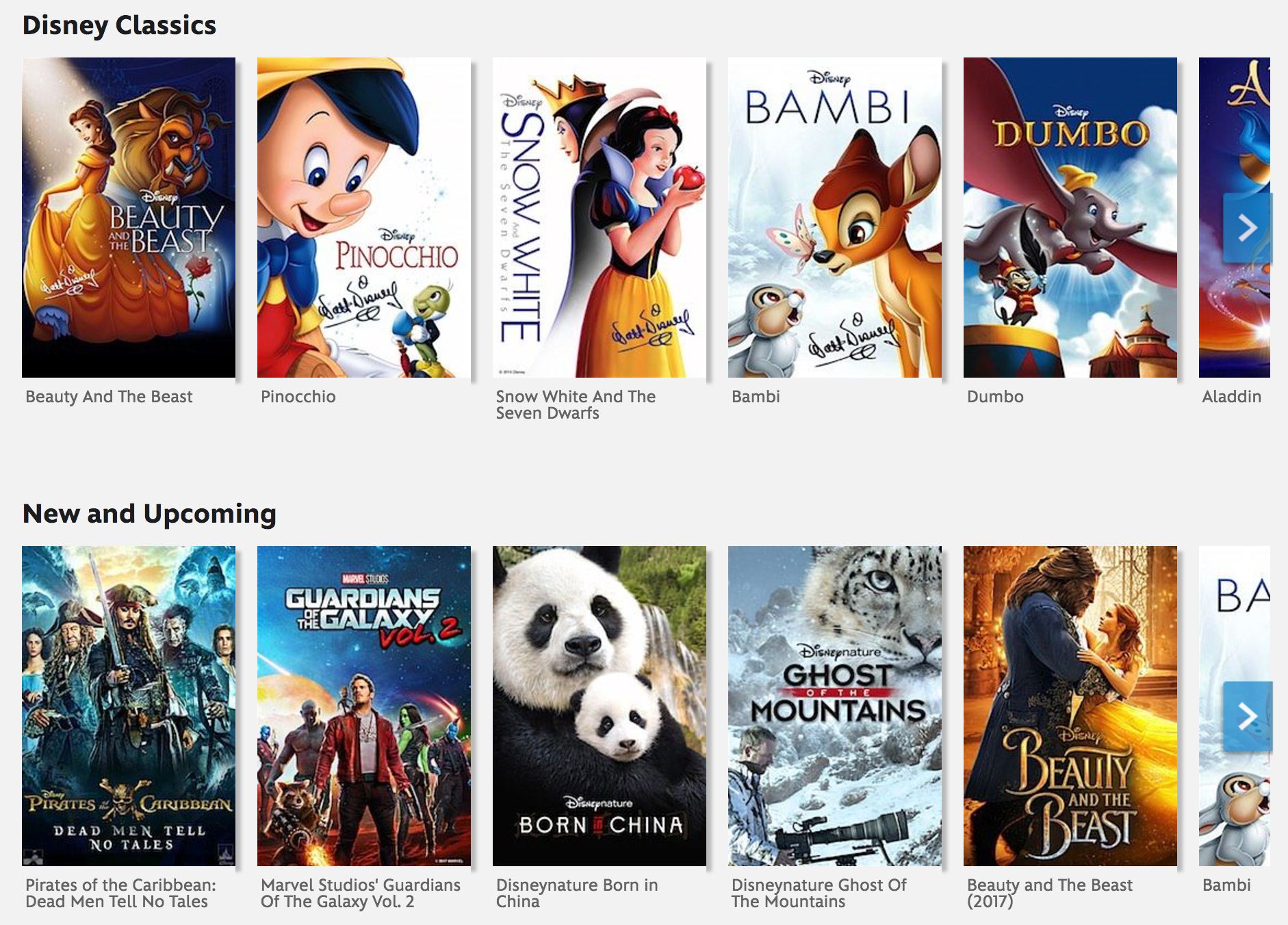

Iger also specified that the content of the service will comprise 4 to 5 original Disney-branded films made exclusively and 4 to 5 original TV series among a library of 500 movies and 7000 episodes also made up of all the Pixar, Star Wars and Marvel productions. He added that the platform will include “thousands of shorts” and will produce many more especially for it. (So far, so good.)

It is still unknown how much Disney will ask for each subscription to its service and how much the company is actually investing in it. But even though these details are yet to be revealed, it’s fair to wonder if the move ultimately really was the right one to make at a time of fierce competition, and therefore whether or not it is doomed to fail.

A look at Disney’s current online video service, Disney Movies Anywhere, might actually give us a glimpse of what’s coming. Offering the company’s entire movie library, the platform, although not as responsive as most of the top streaming services these days, allows members to purchase any film they want along with all their bonus features (a real plus that Netflix could certainly draw inspiration from!). But owning a Disney movie comes at a price ($19.99 to be exact) and if you consider renting instead, it will still cost you $3.99 each time. Compared to Netflix’s $9.99 and Hulu’s $11.99 monthly unlimited consumption offerings, the company still has a long way to go to make its content attractive and affordable.

It’s certain that products from the Disney brand, synonym of great quality with an incomparable international popularity, will be expensive. But what the company will need to grasp before deciding to fix lofty prices is that between all the streaming services now on the market, viewers’ resources make their choices more carefully curated. Consequently, only betting on its fame and reputation to make a profit will not be enough for Disney to stand out.

After last August’s announcement that Disney will remove its entire library from Netflix, a petition appeared online asking the company to reconsider its decision as it would restrict people’s entertainment choices on a limited budget. The appeal today counts more than 15,000 signatures with a goal of 16,000. “The move might make business sense for Disney, which is eager to get a piece of the streaming pie, but the people who power their business should be taken into account too,” says the petition started on organizing site Care2.

With, in addition, a plan to launch an ESPN standalone streaming service, Disney might well be shooting for the stars here by just offering more for more. A mistake that would, in fact, favor Netflix whose diverse offering could, in comparison, seduce even more, although it doesn’t mean that the currently leading VOD service will not suffer consequences from Disney’s withdrawal, too.

The reason why Netflix could be impacted in the process is that the streaming giant widely depends on movies and TV shows from major entertainment companies despite its original programming. However, having ‘stolen’ Shonda Rhimes from ABC (part of the Disney group) and still competing directly with the giant through agreements with other animation companies like DreamWorks represent good steps towards avoiding a potential collapse – yet, it might not be sufficient in the long run.

“Netflix is at the mercy of content owners and can only secure its future and justify its valuation if it successfully develops compelling, owned, original content,” says a financial analyst from Wedbush. “The fairytale has an unhappy ending.”

Only the future will tell if Disney’s choice will prove to be fruitful or rather a disaster for the company. But in view of the challenge of entering a race that started long ago in a business where diversity is the key, Netflix and Disney might as well be better off sticking together.